A Financial Planning & Financial Health Creation Platform For

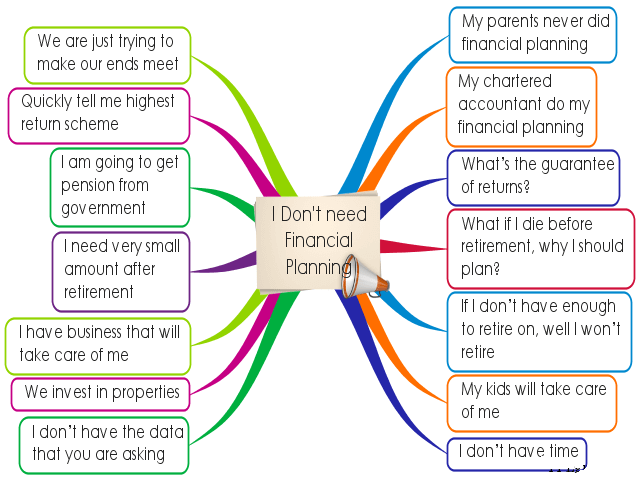

Why You Need Financial Planning

In the end, correct financial planning principles are what play the biggest role in determining our investing success. unfortunately, most of us end up chasing short term returns during our investment planning journeys, leading to a poor experience. Instead, basing your investment plan on the foundation of a solid Financial Planning process can help you control and manage detrimental investing behaviours like greed and fear, thereby keeping you focused on the big picture instead of worrying about short term fluctuations or trends. Financial Planning also helps you maintain a balanced approach towards your cash flows and savings, thereby ensuring that your key financial health ratios are in check. Most importantly, the process of financial planning exponentially increases your chances of meeting your long-term goals in a systematic and disciplined manner. To sum up, financial planning acts as a roadmap towards a better financial future, reduced financial stress, and a greatly enhanced investment planning journey.

WITHOUT A PLAN

WITH A PLAN

In life, making those decisions on your investments or insurance or expenses are scary and yet, unavoidable.

This is where we come in to take care of your financial decisions so that you can live a life that you always wanted.

Get Expert Financial Advice. Become Wealthy The Right Way.

PLAN

Get customized advice across investments, goals, expenses, insurance, loans, estate planning, and taxes

EXECUTE

Get customized advice across investments, goals, expenses, insurance, loans, estate planning, and taxes

MANAGE

Track your journey and review/rebalance your investments to make sure they are aligned with your goals

Plan your Financial Goals with us

Goals: We spend time to understand your needs and aspirations and prepare a financial plan to achieve them.

Protect: We help you to prepare yourself if things go wrong financially. We identify what insurance is required to protect yourself and your family.

Asset Allocation: We arrive at the right asset allocation for you based on your risk profile and life stage. We even chalk out a plan for you to move from current to the recommended asset allocation.

Tax & Estate planning: We provide advice on better tax efficient products so that you can invest smartly. We come up with Estate plan for wealth distribution to your future generation.

Seafarers money clinic

Testimonials

Mumbai

Nellore

Mumbai